UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to SectionPROXY STATEMENT PURSUANT TO SECTION 14(a) of

the Securities Exchange Act ofOF THE

SECURITIES EXCHANGE ACT OF 1934 (Amendment No. )

| | |

Filed by the Registrantý☒ |

Filed by a Partyparty other than the Registranto☐ |

Check the appropriate box: | |

o☒ |

|

Preliminary Proxy Statement |

o☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)14a‑6(e)(2)) |

ý☐ |

|

Definitive Proxy Statement |

o☐ |

|

Definitive Additional Materials |

o☐ |

|

Soliciting Material under §240.14a-12

§240.14a‑12 |

STREAMLINE HEALTH SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

Streamline Health Solutions, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý☒ |

|

No fee required. |

o |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)14a‑6(i)(1) and 0-11. 0‑11. |

| |

(1) | (1) | | Title of each class of securities to which transaction applies:

Not Applicable |

| |

(2) | (2) | | Aggregate number of securities to which transaction applies:

Not Applicable |

| |

(3) | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-110‑11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

(4) | (4) | | Proposed maximum aggregate value of transaction:

|

| |

(5) | (5) | | Total fee paid:

|

o |

|

☐ |

Fee paid previously with preliminary materials. |

o |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

(1) |

|

(1) |

|

Amount Previously Paid:

| |

| | |

(2) | | Form, Schedule or Registration Statement No.:

| |

| | (3) | | Filing Party:

|

(3) | Filing Party: | (4) |

| | |

(4) | Date Filed:

| |

| | |

PRELIMINARY PROXY STATEMENT— SUBJECT TO COMPLETION, DATED [•], 2020

STREAMLINE HEALTH SOLUTIONS, INC.

December 28, 2018Atlanta, Georgia 30361

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

Dear Fellow Stockholder,Stockholder:

On behalf of the boardBoard of directors, I cordially invite you to attend the 2018 Annual Meeting of StockholdersDirectors (the “Board”) of Streamline Health Solutions, Inc. (the “Company”), which will be held at the offices of Troutman Sanders, 600 Peachtree Street, Suite 3000, Atlanta, Georgia 30308, on Tuesday, January 29, 2019, commencing at 9:30 a.m., Eastern Time. The mattersyou are cordially invited to be acted upon at the meeting are described in the attached Notice of Annualattend a special Meeting of Stockholders and Proxy Statement.

Your vote on the business(the “Special Meeting”) to be considered at the meeting is important, regardless of the number of shares you own. To ensure your representation at the Annual Meeting, you are urged to vote by proxy via the Internet or telephone pursuant to the instructions provided in the enclosed proxy card; or by completing, dating, signing and returning the enclosed proxy card.

The Notice of Annual Meeting of Stockholders and Proxy Statement contain information about the official business of the Annual Meeting. Whether or not you expect to attend, please vote your shares now. Of course, if you decide to attend the Annual Meeting, you will have the opportunity to revoke your proxy and vote your shares in person. The Notice of Annual Meeting of Stockholders and Proxy Statement also are available at http://www.edocumentview.com/STRM.

Regards,

David W. Sides

President and Chief Executive Officer

STREAMLINE HEALTH SOLUTIONS, INC.

1175 Peachtree Street NE, 10th Floor

Atlanta, Georgia 30361

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JANUARY 29, 2019

To the Stockholders of Streamline Health Solutions, Inc.:

Notice is hereby given that the Annual Meeting of the Stockholders of Streamline Health Solutions, Inc. will be held on January 29, 2019,[•], 2020 at 9:30 a.m.,[•] [a.m. / p.m.] Eastern Time at the offices of Troutman Sanders LLP, 600 Peachtree Street, NE, Suite 3000, Atlanta, Georgia 30308,30308.

Information Concerning Solicitation and Voting

The Board is soliciting proxies for the following purposes:

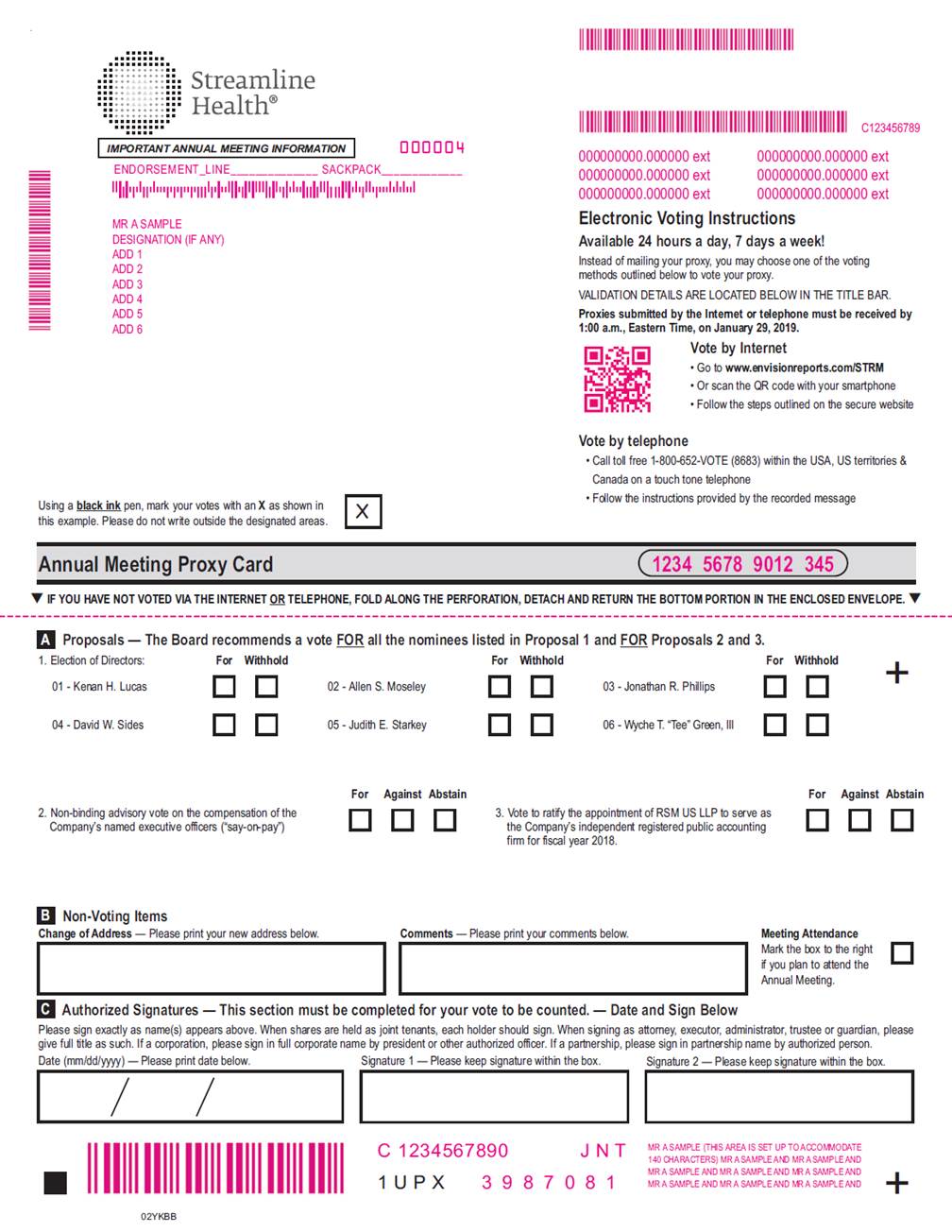

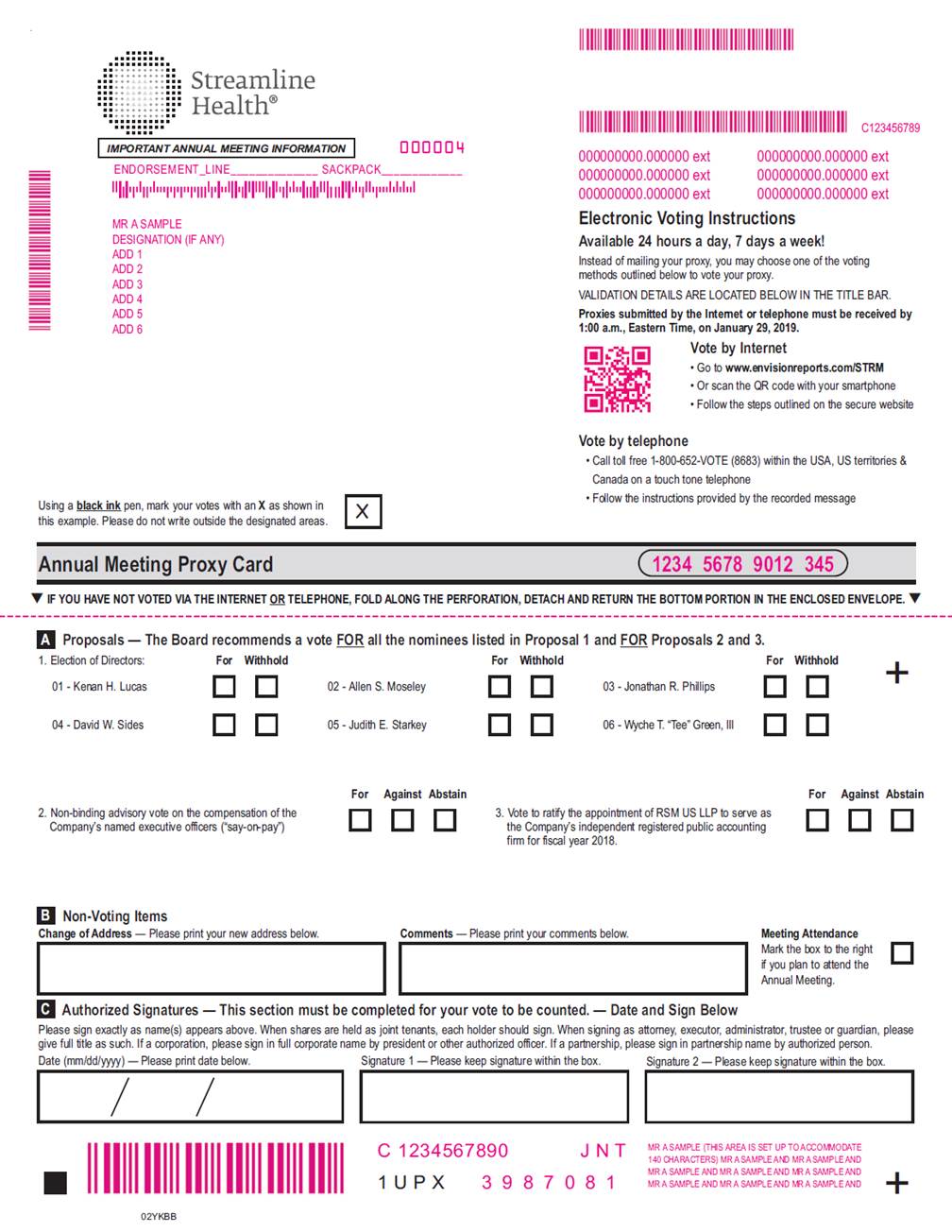

1.PROPOSAL 1—To elect the six candidates nominated by our board of directorsSpecial Meeting to serve as directors until a successor is duly elected and qualified at the 2018 Annual Meeting of Stockholders or otherwise or until any earlier removal or resignation.

2.PROPOSAL 2—To approve a non-binding advisorybe held on [•], 2020. This Proxy Statement contains information for you to consider when deciding how to vote on the compensationmatters brought before the Special Meeting.Voting materials, which include the Proxy Statement and the Proxy Card, are being mailed to stockholders on or about [•], 2020. The executive office of our named executive officers ("say-on-pay"Company is located at 1175 Peachtree Street NE, 10th Floor, Atlanta, Georgia 30361.

As previously announced, on December 17, 2019, the Company, along with Streamline Health, Inc., the Company’s wholly-owned subsidiary, entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) providing for the sale to Hyland Software, Inc. (“Buyer”) of our enterprise content management business (the “ECM Business”), including the customer base relating to the ECM Business (including all license, services and maintenance contracts with such customers), the intellectual property used in connection with the ECM Business, the accounts receivables associated with the ECM Business, and certain equipment and systems used in connection with the ECM Business, all on the terms and subject to the conditions set forth in the Asset Purchase Agreement (such sale, the “Asset Sale Transaction”).

3.PROPOSAL 3—To ratify We do not believe that the appointmentsale of the firmECM Business, under Delaware law, would be deemed a sale of RSM US LLPall, or substantially all, of our assets, to servethe Buyer on the terms and subject to the conditions set forth in the Asset Purchase Agreement, but are seeking stockholder approval regarding the sale of the ECM Business because the Board considered the action appropriate, and strongly desired the input of the Company’s stockholders, given the historical significance of the line of business. As consideration for the Asset Sale Transaction, Buyer has agreed to pay the Company $16 million in cash, subject to certain adjustments as our independent registered public accounting firmset forth in the Asset Purchase Agreement.At the Special Meeting, stockholders will be asked to:

1.Approve the Asset Purchase Agreement, the Asset Sale Transaction and the other transactions contemplated by the Asset Purchase Agreement (the “Asset Sale Proposal”);

2.Approve a proposal to adjourn or postpone the Special Meeting, if necessary or appropriate, for fiscal year 2018.

4.To consider anythe purpose of soliciting additional votes for the approval of the Asset Sale Proposal (the “Adjournment Proposal”); and all3.Transact such other business that may properly come before the meeting ormeeting.

Stockholders are referred to the Proxy Statement accompanying this notice for more detailed information with respect to the matters to be considered at the Special Meeting. After careful consideration, the Board has unanimously determined that the Asset Purchase Agreement and the transactions contemplated thereby, including the Asset Sale Transaction, are advisable, fair to and in the best interests of the Company and its stockholders and recommends that you vote “FOR” the Asset Sale Proposal (Proposal One); and “FOR” the Adjournment Proposal (Proposal Two); and, in the proxy holder’s best judgment, as to any adjournment thereof.

other matters that may properly come before the Special Meeting.All stockholders are invited to attend the Special Meeting. The close of business on [•] is the record date for determining stockholders entitled to notice of, and to vote at, the Special Meeting. Consequently, only stockholders whose names

appear on our books as owning our common stock at the close of business on December 17, 2018[•] will be entitled to notice of, and to vote at, the AnnualSpecial Meeting of Stockholders and any adjournment or postponement thereof.

| | |

| | By Order of the Board of Directors |

|

|

|

| | Thomas J. Gibson

Senior Vice President and Chief Financial Officer |

Atlanta, Georgia

December 28, 2018

YOUR VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT.

AIf your shares are registered in your name, even if you plan to attend the Special Meeting or any adjournment or postponement of the Special Meeting in person, we request that you vote by telephone, over the Internet, or complete, sign and mail your proxy card to ensure that your shares will be represented at the Special Meeting.

If your shares are held in the name of a broker, bank or other nominee, and you receive notice of the Special Meeting through your broker, bank or other nominee, please vote or complete and return the materials in accordance with the instructions provided to you by such broker, bank or other nominee or contact your broker, bank or other nominee directly in order to obtain a proxy issued to you by your nominee holder to attend the Special Meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the Special Meeting.

The accompanying Proxy Statement contains important information concerning the Special Meeting, the transactions contemplated by the Asset Purchase Agreement and related matters, including information as to how to cast your vote. We encourage you to read the accompanying Proxy Statement and the Asset Purchase Agreement and other annexes to the Proxy Statement carefully and in their entirety.

The Asset Sale Proposal must be approved by the holders of a majority of the outstanding shares of the Company’s common stock entitled to vote at the Special Meeting. Therefore, if you do not vote by proxy or attend the Special Meeting and vote in person or, if you hold your shares in “street name,” properly instruct your broker, bank or other nominee with respect to voting your shares, it will have the same effect as if you voted “AGAINST” the Asset Sale Proposal.

Your vote is important to us. Please complete, sign, date and promptly return the proxy card are included herewith. As a stockholder, you are urged to vote. See "General Information—Voting Methods" in the included Proxy Statement for more information on your voting options. It is importantenclosed envelope, so that your shares will be voted. In orderrepresented whether or not you attend the Special Meeting. Returning a proxy card will not deprive you of your right to avoidattend the additional expense of further solicitation, we askSpecial Meeting and vote your cooperationshares in voting promptly.person.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2018 ANNUALSPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON JANUARY 29, 2019.[•]:

Our Notice of Annual Meeting of Stockholders, Proxy Statement for the 2018 Annual Meeting of Stockholders and 2017 Annual Report to Stockholders are also available at THIS NOTICE OF SPECIAL MEETING, PROXY STATEMENT AND PROXY CARD ARE AVAILABLE AT http://www.edocumentview.com/STRM.

STREAMLINE HEALTH SOLUTIONS, INC.

1175 Peachtree Street NE, 10th Floor

Atlanta, Georgia 30361

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JANUARY 29, 2019

GENERAL INFORMATION

Introduction.

We are furnishing this

| |

| By order of the Board of Directors |

Dated: January [•], 2020 | |

| |

| Thomas J. Gibson |

| |

Atlanta, Georgia | Senior Vice President and Chief Financial Officer |

January [•], 2020 | |

Neither the Securities and Exchange Commission nor any state securities regulatory agency has approved or disapproved of the Asset Sale Transaction, passed upon the merits or fairness of the Asset Sale Transaction or passed upon the adequacy or accuracy of the accompanying Proxy Statement. Any representation to the contrary is a criminal offense.

The accompanying Proxy Statement on behalf of the board of directors of Streamline Health Solutions, Inc.is dated [•], a Delaware corporation, for use at our 2018 Annual Meeting of Stockholders, or at any adjournments or postponements of the meeting (the "Annual Meeting"), for the purposes set forth below2020, and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the offices of Troutman Sanders, 600 Peachtree Street, Suite 3000, Atlanta, Georgia 30308, at 9:30 a.m. Eastern Time, on Tuesday, January 29, 2019. You may obtain directions to the location of the Annual Meeting by visiting http://www.edocumentview.com/STRM.

As used in this Proxy Statement, the terms "Streamline," the "company," "we," "us," and "our" refer to Streamline Health Solutions, Inc. The term "common stock" means shares of our common stock, par value $.01 per share. The term "preferred stock" means shares of our Series A 0% Convertible Preferred Stock, par value $.01 per share.

This Proxy Statement and the enclosed proxy card areis first being mailed to stockholders on or about [•], 2020.

STREAMLINE HEALTH SOLUTIONS, INC.

1175 Peachtree Street, NE, 10th Floor

Atlanta, Georgia 30361

SUMMARY TERM SHEET

This summary highlights selected information contained elsewhere in this Proxy Statement and may not contain all the information that is important to you with respect to the Asset Purchase Agreement, the Asset Sale Proposal and the other transactions contemplated by the Asset Purchase Agreement and the other matters being considered at the Special Meeting of the Company’s stockholders to which this Proxy Statement relates. We urge you to read carefully the remainder of this Proxy Statement, including the attached annexes, and the other documents to which we have referred you. For additional information on the Company, see the section entitled “Where You Can Find More Information” beginning on page 67. We have included page references in this summary to direct you to a more complete description of the topics presented below.

All references in this Proxy Statement to:

“Streamline,” the “Company,” “we,” “us,” or “our” refer to Streamline Health Solutions, Inc.,

“Buyer” refers to Hyland Software, Inc., in its capacity as Buyer under the Asset Purchase Agreement,

the “Asset Purchase Agreement” refers to the Asset Purchase Agreement, dated as of December 28, 2018. 17, 2019, by and between the Company, Streamline Health, Inc., and Buyer, as amended on January 7, 2020,

the “Asset Sale Transaction” refers to the sale of the ECM Business, as contemplated by the Asset Purchase Agreement, together with the other transactions contemplated by the Asset Purchase Agreement,

the “ECM Business” refers to our enterprise content management business, including the customer base relating to the ECM Business (including all license, services and maintenance contracts with such customers), the intellectual property used in connection with the ECM Business, the accounts receivables associated with the ECM Business, and certain equipment and systems used in connection with the ECM Business, and

the “Ancillary Agreements” refers to the Escrow Agreement, the Bill of Sale, the Assignment and Assumption Agreement, and the IP Assignment each by and between the Company and Buyer.

Information about the Parties (see page 24)

The Company

Incorporated in 1989, we are a leading provider of integrated solutions, technology-enabled services and analytics to support revenue cycle optimization for healthcare enterprises throughout the United States and Canada. The focus of our SaaS-based healthcare information technology is to help optimize mid-revenue cycle processes for providers, from charge capture to bill drop. We work with our clients as full-service revenue integrity partners organization-wide. Our eValuator™ pre-bill coding analysis platform enables hospitals, clinics and physician practices to analyze every coded patient record before it is billed to payors, improving revenue integrity and decreasing denials. Our comprehensive suite of solutions and services includes: enterprise content management, business analytics, integrated workflow systems, clinical documentation improvement, automated pre-bill coding analysis and pre- or post-bill manual auditing services.

We are incorporated under the laws of the State of Delaware. Our executive office is located at 1175 Peachtree Street, NE, 10th Floor, Atlanta, Georgia 30361. Our telephone number is (888) 997‑8732. Our website is http://www.streamlinehealth.net. The information contained on the Company’s website is not incorporated into this proxy statement.

Our common stock is listed on The NASDAQ Capital Market under the ticker symbol “STRM”.

Buyer

Hyland Software, Inc., based in Westlake, Ohio, provides connected healthcare solutions that harness unstructured content at all corners of the enterprise and link it to core clinical and business applications such as electronic medical records (EMR) and enterprise resource planning (ERP) systems. Hyland is the only technology partner that offers a full suite of content services and enterprise imaging tools, bringing documents, medical images and other clinically rich data to the healthcare stakeholders that need it most. This comprehensive view of patient information accelerates business processes, streamlines clinical workflows and improves clinical decision making. Hyland’s website is http://www.Hyland.com. The information contained on Hyland’s website is not incorporated into this proxy statement.

The Asset Purchase Agreement (see page 38 and Annex A)

On December 17, 2019, we entered into the Asset Purchase Agreement with Buyer pursuant to which we have agreed, subject to certain conditions, including the approval of the Asset Purchase Agreement and the Asset Sale Transaction by our stockholders at the Special Meeting or any adjournment or postponement thereof (the “Stockholder Approval”), to sell to Buyer the ECM Business. Under the terms of the Asset Purchase Agreement, we will retain certain specified assets, including all of our cash and cash equivalents, certain contracts that are not expressly assumed by Buyer, all intellectual property owned by us other than intellectual property owned (in whole or in part) by or exclusively licensed to us and related to, used or held exclusively for use in connection with the ECM Business, and certain other assets specified in the Asset Purchase Agreement, and will also retain certain specified liabilities, including all liabilities with respect to taxes arising before the closing of the Asset Sale Transaction, all liabilities and obligations with respect to current and former employees of the Company based upon or arising out of the employment relationship with the Company, indebtedness, change of control bonus or severance obligations, liabilities associated with any warranties or services provided by the Company prior to the closing of the Asset Sale Transaction and other specified retained liabilities.

The Company’s Business Following the Asset Sale Transaction

We will continue to operate and manage our eValuator Coding Analysis Platform, CDI and Abstracting solutions, Financial Management solutions, Audit Services, and custom integration and training services following the closing of the Asset Sale Transaction.

The Company offers software solutions and services to assist its clients in revenue cycle management, primarily with issues they face in the middle of their revenue cycle - from initial charge capture to bill drop. The technologies include Coding and Clinical Documentation Improvement (CDI), Health Information Management (HIM), Financial Management and eValuator™, its flagship, automated, cloud-based technology platform which enables healthcare providers to analyze the accuracy of their coding on 100% of their patient records prior to billing. This new technology represents a paradigm shift for the industry as the vast majority of healthcare providers manually audit a small, random sample of coded records well after they have been billed.

The Company’s solutions are designed to improve the flow of critical patient information throughout the healthcare enterprise. The solutions and services help to transform and structure information between disparate information technology systems into actionable data, giving the end user comprehensive access to clinical and business intelligence to enable better decision-making. Solutions can be accessed securely through Software as a Service (SaaS), or delivered via on-premise equipment, although this now represents a minority of the company’s delivery methodology. Payment methods for these solutions is either monthly (for SaaS-based solutions) or by perpetual or fixed-term license if installed locally.

The ongoing business for the Company following the Asset Sale Transaction will center primarily on its technologies, the eValuator platform and coding and abstracting platforms. The Company supports the eValuator technology with its service businesses, both professional services and coding and audit services. The Company believes that the eValuator platform represents the Company’s greatest opportunity for revenue growth.

Ongoing Technology-Enabled Platforms Following the Asset Sale Transaction

eValuator Automated Coding Analysis Platform - This technology is a cloud-based SaaS analytics solution that delivers the capability of fully automated analysis on 100% of coded patient records entered by a healthcare provider’s coding team. This can be done on a pre-bill (or post-bill) basis, enabling providers to identify and address the cases with the highest potential impact, both in terms of dollars and propensity to be incorrectly coded, prior to bill drop. Rule sets are currently available for both Inpatient and Outpatient records and Professional Fee cases (ProFee) automated analysis is in development. With eValuator, providers can add an audit and review function on a pre-bill basis to all cases, allowing them to better optimize its billing practices to improve its revenue integrity both in terms of receiving full reimbursement for the care provided as well as mitigating the risk of over coding or over billing.

Coding & CDI Solutions - These technology solutions provide an integrated cloud-based software suite that enhances the productivity of CDI and Coding staff and enables the seamless sharing of patient data. The Company’s technology includes CDI, Abstracting and Physician Query.

Ongoing Professional Service Enabled Offerings Following the Asset Sale Transaction:

Audit Services — The Company provides technology-enabled coding audit services through the use of its eValuator platform, to help clients review and optimize their internal clinical documentation and coding functions across the applicable segment of the client’s enterprise. The Company provides these services using experienced auditors and its eValuator proprietary software to improve the targeting of records with the highest likelihood of change, thereby requiring an audit. The audit services are provided for inpatient DRG coding, Outpatient APC auditing, HCC auditing and Physician/Pro-Fee services coding auditing.

Training Services — Training courses are offered to help clients quickly learn to use our solutions in the most efficient manner possible. Training sessions are available on-site or off-site for multiple staff members or as few as one person.]

A copy of the 2017 Annual ReportAsset Purchase Agreement is attached as Annex A to Stockholders,this Proxy Statement. You are encouraged to read the Asset Purchase Agreement carefully and in its entirety.

Consideration for the Asset Sale Transaction (see page 25)

As consideration for the Asset Sale Transaction, Buyer has agreed to pay us $16 million in cash at closing, subject to certain adjustments as set forth in the Asset Purchase Agreement.

Special Meeting (see page 20)

Purpose

At our Special Meeting, stockholders will act upon the matters outlined in the notice, including the Annual Report on Form 10-Kfollowing:

a proposal to approve the Asset Purchase Agreement and the Asset Sale Transaction (the “Asset Sale Proposal”);

a proposal to adjourn or postpone the Special Meeting, if necessary or appropriate, for the fiscal year ended January 31, 2018, as filed with the Securities and Exchange Commission (the "SEC"), is being mailed with this Proxy Statement.

Important Notice Regarding the Availabilitypurposes of Proxy Materialssoliciting additional votes for the Stockholder Meeting To Be Held on January 29, 2019:

This Proxy Statement andapproval of the 2017 Annual Report to Stockholders are available at http://www.edocumentview.com/STRM.Asset Sale Proposal (the “Adjournment Proposal”); and

such other business that may properly come before the meeting

Our stockholders must vote to approve the Asset Sale Proposal as a condition for the Asset Sale Transaction to occur. If the Company’s stockholders fail to approve the Asset Sale Proposal, the Asset Sale Transaction will not occur.

Stockholders Entitled to Notice and to Vote

All holders of record of our common stock and our preferred stock at the close of business on December 17, 2018[•] (the "Record Date"“Record Date”), will be entitled to notice of and to vote at the AnnualSpecial Meeting. Our shares of common stock and preferred stock vote together as a single class.

At the close of business on the Record Date, we had 20,127,703[•] shares of common stock outstanding and entitled to vote and 2,895,464 shares of preferred stock outstanding and entitled to vote. Holders of common stock are entitled to one vote for each share of our common stock held. Holders of preferred stock are entitled to vote such shares on a modified converted basis with each holder of preferred stock entitled to such number of votes equal to the total number ofNo other shares of preferredcommon stock held multiplied by 75%, rounded down to the nearest whole share. Unless waived, holders of our preferred stock are subject to certain beneficial ownership limitations. As ofwere outstanding on the Record Date, the holders of preferred stock were entitled to an aggregate of 2,171,598 votes. Shares of our common stock and preferred stock may not be voted cumulatively.

QuorumDate.

Quorum

Our bylaws provide that the holders of a majority of all of the shares of our capitalcommon stock issued, outstanding, and entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the AnnualSpecial Meeting. Shares that are voted FOR, AGAINST, WITHHELD, or ABSTAIN, as applicable, with respect to a matter are treated as being present at the meeting for purposes of establishing a quorum.

Distinction between Holding Shares as a Stockholder of Record and as a Beneficial Owner

Some of our stockholders hold their shares through a broker, trustee, or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those shares owned beneficially.

Stockholder of Record.Record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are considered, with respect to those shares, the "stockholder“stockholder of record."” As the stockholder of record, you have the right to grant your voting proxy directly to us or to a third party, or to vote in person at the AnnualSpecial Meeting.

Beneficial Owner.Owner. If your shares are held in a brokerage account, by a trustee or by another nominee, then you are considered the "beneficial owner"“beneficial owner” of those shares. As the beneficial owner of those shares, you have the right to direct your broker, trustee, or nominee how to vote and you also are invited to attend the AnnualSpecial Meeting. However, because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the AnnualSpecial Meeting unless you obtain a "legal proxy"“legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the AnnualSpecial Meeting.

If you are not a stockholder of record, please understand that we do not know that you are a stockholder, or how many shares you own.

Required Vote

For Proposal One, the approval of the Asset Sale Proposal requires the affirmative vote of the holders of a majority of the outstanding shares of our common stock as of the close of business on the Record Date.

For Proposal Two, regardless of whether a quorum is present at the Special Meeting, the affirmative vote of a majority of the votes cast by stockholders present in person or represented by proxy at the Special Meeting is required to approve the Adjournment Proposal.

Abstentions and broker non-votes are counted to determine whether a quorum is present at the Special Meeting but are not counted as a vote in favor of or against a particular matter.

Voting

Your vote is very important to us and we hope that you will attend the Special Meeting. However, whether or not you plan to attend the Special Meeting, please vote by proxy in accordance with the instructions on your proxy card or voting

instruction card (from your broker, bank or other nominee). Below are descriptions of how you may vote your shares depending on whether or not you are a stockholder of record or a beneficial owner.

Stockholders of Record

By Mail.Registered stockholders may vote their shares by signing, dating and mailing the enclosed proxy card using the enclosed postage pre-paid envelope. We strongly encourage you, however, to consider using the Internet or telephone voting options described below because these voting methods are faster and less costly than voting by mailing your signed and dated proxy card. If you vote via the Internet or telephone, you do not need to mail your proxy card.

By Internet.Registered stockholders may vote on the Internet at http://www.envisionreports.com/STRM. Please have your proxy card in hand when going online and follow the online instructions. Stockholders that vote by Internet must bear all costs associated with electronic access, including Internet access fees. Internet voting for registered stockholders is available up until 1:00 a.m.[•] [a.m. / p.m.], CentralEastern Time, on January 29, 2019,[•], 2020, the day of the AnnualSpecial Meeting. The Internet voting procedures are designed to authenticate each stockholder by use of a control number to allow stockholders to vote their shares and to confirm that their instructions have been properly recorded. The control number can be found on the enclosed proxy card.

By Telephone.Registered stockholders also may vote by telephone by calling 1-800-652-8683800-652-VOTE (8683) (toll-free) and using any touch-tone telephone to transmit their votes up to 1:00 a.m.[•] [a.m. / p.m.], CentralEastern Time, on January 29, 2019,[•], 2020, the day of the AnnualSpecial Meeting. Please have your proxy card in hand when you call and then follow the instructions. The control number necessary to vote your shares by telephone can be found on the enclosed proxy card.

By Attending the AnnualSpecial Meeting.If you attend the AnnualSpecial Meeting and wish to vote in person, you may request a ballot when you arrive. Alternatively, if you are a registered stockholder and attend the AnnualSpecial Meeting, you may deliver your signed and dated proxy card in person. You must present a valid photo identification for admission to the AnnualSpecial Meeting.

If your shares are held of record in the name of a bank, broker or other nominee you should follow the separate instructions that the nominee provides to you. Although most banks and brokers now offer Internet and telephone voting, availability and specific processes will depend on their voting arrangements.

If your shares are held of record in the name of your bank, broker or other nominee and you would like to vote in person at the AnnualSpecial Meeting, you must bring to the AnnualSpecial Meeting a letter from the nominee indicating that you were the beneficial owner of the shares on the Record Date and have been granted a proxy by your bank, broker or nominee to vote the shares. You also must present a valid photo identification for admission to the AnnualSpecial Meeting.

Voting Requirements

At the Annual Meeting, stockholders will consider and act upon (1) the election of six directors for terms expiring at the 2019 Annual Meeting of Stockholders, (2) the approval of a non-binding advisory vote on the compensation of our named executive officers ("say-on-pay"), (3) the ratification of RSM US LLP to serve as the company's independent registered public accounting firm for fiscal year 2018, and (4) such other business as may properly come before the Annual Meeting.

With regard to Proposal 1 (Election of Directors), votes may be cast for the nominees or may be withheld. All nominees are current directors. The election of directors requires a plurality of the votes of the shares present in person or represented by proxy at the Annual Meeting, and the six nominees receiving the greatest number of votes will be elected. Abstentions and broker "non-votes" will have no effect on the outcome of this proposal.

With regard to Proposal 2 ("Say-on-Pay"), votes may be cast for or against the proposal, or stockholders may abstain from voting on the proposal. The approval of Proposal 2 requires the affirmative vote of the majority of the shares present in person or represented by proxy at the Annual Meeting. Abstentions will have the same effect as a vote against this proposal. Broker "non-votes" will not be counted in determining the number of votes cast and, therefore, will have no effect on the outcome of this proposal. The vote on Proposal 2 is a non-binding advisory vote.

With regard to Proposal 3 (Ratification of RSM US LLP), votes may be cast for or against the proposal, or stockholders may abstain from voting on the proposal. The approval of Proposal 3 requires the affirmative vote of the majority of the shares present in person or represented by proxy at the Annual Meeting. Abstentions will have the same effect as a vote against this proposal. Broker "non-votes" will not be counted in determining the number of votes cast and, therefore, will have no effect on the outcome of this proposal.

Treatment of Voting Instructions

If you provide specific voting instructions, your shares will be voted as instructed.

If you hold shares as the stockholder of record and provide a proxy without giving specific voting instructions, then your shares will be voted in accordance with the recommendations of our board of directors. Our board of directors recommends voting "FOR ALL NOMINEES" listed in Proposal 1, "FOR" Proposals 2, and 3, and in accordance with the discretion of the named proxies on other matters brought before the Annual Meeting.Board set forth below.

You may have granted to your broker, trustee, or other nominee discretionary voting authority over your account. Your broker, trustee, or other nominee may be able to vote your shares depending on the terms of the agreement you have with your broker, trustee, or other nominee.

The election of directors is not considered a "routine" matter as to which brokers may vote in their discretion on behalf of clients who have not furnished voting instructions with respect to the election of directors. As a result, if you hold your shares in street name and do not provide your broker with voting instructions, your shares will not be voted at the Annual Meeting with respect to Proposal 1 (Election of Directors) or Proposal 2 ("Say-on-Pay"). The ratification of RSM US LLP as our independent registered public accounting firm is considered a "routine matter," and therefore, brokers will have the discretion to vote on this matter even if they do not receive voting instructions from the beneficial owner of the shares.

The persons identified as having the authority to vote the proxies granted by the proxy card will have discretionary authority to vote, in their discretion, to the extent permitted by applicable law, on such other business as may properly

come before the AnnualSpecial Meeting and any postponement or adjournment. The board of directorsBoard is not aware of any other matters that are likely to be brought before the AnnualSpecial Meeting. If

Solicitation of Proxies

We are soliciting proxies on behalf of the Board. The solicitation of proxies will be conducted by telephone or mail, and we will bear all attendant expenses. These expenses will include the expense of preparing and mailing proxy materials for the Special Meeting. Brokerage firms and other custodians, nominees and fiduciaries will be requested to forward the proxy materials to beneficial owners and to obtain authorization for the execution of proxies, and we will reimburse such brokerage firms, other custodians, nominees and fiduciaries for reasonable expenses incurred in sending proxy materials to beneficial owners of our common stock. We may conduct further solicitation personally or telephonically through our directors, officers, and employees, none of whom will receive additional compensation for assisting with the solicitation.

Recommendation of Our Board (see page 20)

After careful consideration, our Board unanimously recommends that you vote:

Proposal One - FOR the Asset Sale Proposal; and

Proposal Two - FOR the Adjournment Proposal.

In reaching its decision to approve the Asset Purchase Agreement and the Asset Sale Transaction and to recommend that you vote in the manner noted above, our Board considered a wide range of material factors relating to the Asset Purchase Agreement and the Asset Sale Transaction and consulted with management and outside financial and legal advisors. For more information on these factors, see “Proposal One: Asset Sale Proposal - Reasons for the Asset Sale Transaction and Recommendation of Our Board” beginning on page 27 below.

Opinion of the Financial Advisor to the Company (see page 29)

On December 14, 2019, Houlihan Lokey Capital, Inc. (“Houlihan Lokey”) rendered its oral opinion to the Board (which was subsequently confirmed in writing by delivery of Houlihan Lokey’s written opinion addressed to the Board dated the same date) as to, as of December 14, 2019, the fairness, from a financial point of view, to the Company of the consideration to be received by the Company and Streamline Health, Inc. (collectively, “Seller”) in the Asset Sale Transaction pursuant to the Asset Purchase Agreement in exchange for the assets as described in the Asset Purchase Agreement relating to the ECM Business (the “Purchased Assets”), subject to certain liabilities of Seller as described in the Asset Purchase Agreement to be assumed by Buyer in the Asset Sale Transaction (the “Assumed Liabilities”).

Houlihan Lokey’s opinion was directed to the Board (in its capacity as such), and only addressed the fairness, from a financial point of view, to the Company of the consideration to be received by Seller in exchange for the Purchased Assets subject to the Assumed Liabilities in the Asset Sale Transaction pursuant to the Asset Sale Agreement and did not address any other aspect or implication of the Asset Sale Transaction, any related transaction or any other agreement, arrangement or understanding entered into in connection therewith or otherwise. The summary of Houlihan Lokey's opinion in this Proxy Statement is qualified in its entirety by reference to the full text of its written opinion, which is included as Annex B to this Proxy Statement and describes the procedures followed, assumptions made, qualifications and limitations on the review undertaken and other matters considered by Houlihan Lokey in connection with the preparation of its opinion. However, neither Houlihan Lokey's written opinion nor the summary of its opinion and the related analyses set forth in this Proxy Statement is intended to be, and they do not constitute, a recommendation to the Board, any security holder of the Company or any other person as to how such person should vote or act with respect to any matter relating to the Asset Sale Transaction or otherwise.

Use of Proceeds and Future Operations (see page 37)

The Company, and not its stockholders, will receive the proceeds from the Asset Sale Transaction. The Company plans to use the proceeds of the sale to pay off its term loan with Bridge Bank and to fund the continuing development and incremental investment in sales and marketing in support of its eValuator™ cloud-based pre- or post-bill coding analysis platform. We will continue to operate and manage our eValuator Coding Analysis Platform, CDI and Abstracting solutions, Financial Management solutions, Audit Services, and custom integration and training services following the closing of the Asset Sale Transaction. Our Board will evaluate alternatives for the use of the cash proceeds to be received at closing to continue to maximize stockholder value with a goal of returning value to our stockholders. The amounts and timing of our actual expenditures, however, will depend upon numerous factors, and we may find it necessary or advisable to use portions of the proceeds from the Asset Sale Transaction for different or presently non-contemplated purposes.

Expected Timing of the Asset Sale Transaction

We expect to complete the Asset Sale Transaction promptly following the Special Meeting if we obtain Stockholder Approval and the various other conditions to closing are satisfied or waived. However, there can be no assurance that the Asset Sale Transaction will be completed as currently anticipated. Certain factors, including factors outside of our control and the control of Buyer, could result in the Asset Sale Transaction being delayed or not occurring at all.

Covenants (see page 42)

Pursuant to the Asset Purchase Agreement, the Company has agreed to certain covenants with respect to, among other things, the following:

delivery of required consents related to the Asset Sale Transaction;

non-competition and non-solicitation;

transition services to be provided by the Company;

employment of certain Company employees;

access to information;

acquisition proposals; and

certain software platform upgrades.

Closing Conditions (see page 44)

The completion of the Asset Sale Transaction is properly presenteddependent upon the satisfaction of a number of conditions, including:

No Governmental Authority shall have enacted, issued, promulgated, enforced or entered any order which is in effect and has the effect of making the transactions contemplated by the Asset Sale Agreement illegal, otherwise restraining or prohibiting consummation of such transactions or causing any of the transactions contemplated hereunder to be rescinded following completion thereof;

receipt of Stockholder Approval;

the accuracy of the parties’ representations and warranties in the Asset Purchase Agreement as of closing, subject, in certain circumstances, to certain materiality and other thresholds;

the performance by the parties of their obligations and covenants under the Asset Purchase Agreement;

the delivery by the parties of executed counterpart signature pages to each of the Ancillary Agreements referenced in the Asset Purchase Agreement;

the delivery by each party of certain certificates and other documentation;

the delivery by the Company of certain signed letters or other documents from persons holding liens with respect to assets used to conduct the ECM Business releasing all such liens and authorizing the Company to file the appropriate terminations of any financing statements evidencing such liens or any other documents or filings necessary to evidence termination of such liens;

receipt of authorizations, consents, orders and approvals set forth in the Asset Purchase Agreement; and

the absence of any event, fact or development since the signing of the Asset Purchase Agreement that has had or would reasonably be expected to have a material adverse effect on the ECM Business.

Indemnification (see page 44)

Under certain circumstances specified in the Asset Purchase Agreement, the Company and Buyer have agreed to indemnify each other for actioncertain Losses (see page 44 for the definition of “Losses”). See “The Asset Purchase Agreement - Indemnification” beginning on page 44 for a discussion of the circumstances under which such indemnification provisions shall apply.

Termination of the Asset Purchase Agreement (see page 45)

The Asset Purchase Agreement may be terminated at any time prior to the closing of the Asset Sale Transaction by mutual written consent of Buyer and the Company.

Either party may terminate the Asset Purchase Agreement if:

there is any law that makes consummation of the Asset Sale Transaction illegal or otherwise prohibited; or

any Governmental Authority issues an order restraining or enjoining the Asset Sale Transaction, and such order has become final and non-appealable.

Buyer may terminate the Asset Purchase Agreement by written notice to the Company if:

Buyer is not in material breach of the Asset Purchase Agreement, and there has been a material breach of the Asset Purchase Agreement by the Company that would give rise to a failure of any of the conditions to consummate the Asset Sale Transaction and such breach cannot be cured by the Company by March 31, 2020 (the “Drop-Dead Date”);

the Company does not obtain Stockholder Approval of the Asset Sale Transaction (unless such failure is due to the failure of the Buyer to perform or comply with any of the covenants, agreements or conditions of the Asset Purchase Agreement to be performed or complied with by the Buyer prior to the closing); or

any of the conditions to Buyer’s performance of the Asset Purchase Agreement have not been fulfilled by the Drop-Dead Date, including, among other things, that (i) all of the Company’s representations and warranties of the Company are true and correct in all material respects as of the closing date of the Asset Sale Transaction,

(ii) the Company has performed and complied with all agreements covenants and conditions required by the Asset Purchase Agreement and the Ancillary Agreements by or on the closing date of the Asset Sale Transaction, (iii) the Company has delivered certain certificates and consents and approvals to Buyer, (iv) the Company has delivered certain signed letters or other documents from persons holding liens with respect to assets used to conduct the ECM Business releasing all such liens and authorizing the Company to file the appropriate terminations of any financing statements evidencing such liens or any other documents or filings necessary to evidence termination of such liens, and (v) there has not been a material adverse effect with respect to the ECM Business or the Company’s ability to consummate the Asset Sale Transaction.

The Company may terminate the Asset Purchase Agreement by written notice to Buyer if:

Company is not in material breach of the Asset Purchase Agreement, and there has been a material breach of the Asset Purchase Agreement by the Buyer that would give rise to a failure of any of the conditions to consummate the Asset Sale Transaction and such breach cannot be cured by the Company by the Drop-Dead Date;

| · | | the Company does not obtain Stockholder Approval of the Asset Sale Transaction (unless such failure is due to the failure of the Company to perform or comply with any of the covenants, agreements or conditions of the Asset Purchase Agreement to be performed or complied with by the Company prior to the closing); or |

any of the conditions to Company’s performance of the Asset Purchase Agreement have not been fulfilled by the Drop-Dead Date, including, among other things, that (i) Stockholder Approval of the Asset Sale Transaction is obtained; (ii) all of the Buyer’s representations and warranties of the Buyer are true and correct in all material respects as of the closing date of the Asset Sale Transaction, (iii) the Buyer has performed and complied with all agreements covenants and conditions required by the Asset Purchase Agreement and the Ancillary Agreements by or on the closing date of the Asset Sale Transaction, and (iv) the Buyer has delivered certain certificates and consents and approvals to Company.

In the event that the Asset Purchase Agreement is validly terminated pursuant to the termination rights above, the Asset Purchase Agreement will become void without liability or obligation (with certain limited exceptions) on the part of Buyer or the Company, except that if the Asset Purchase Agreement is terminated due to a failure of the Company to convene the Special Meeting by the Drop Dead Date or to have obtained Stockholder Approval, the Company must reimburse Buyer for all costs and expenses of Buyer incurred in connection with the Asset Sale Transaction, up to a maximum amount of $75,000.

Specific Performance (see page 46)

The Asset Purchase Agreement provides that, if any party breaches its covenants under the Asset Purchase Agreement, the non-breaching party may, in addition to any other available rights or remedies, may sue in equity for specific performance, and each party expressly waives the defense that a remedy in damages will not be adequate.

No Appraisal or Dissenters’ Rights (see page 37)

No appraisal rights or dissenters’ rights are available to our stockholders under Delaware law or our articles of incorporation or bylaws in connection with the Asset Sale Transaction.

Risk Factors (see page 16)

In evaluating the Asset Sale Proposal, in addition to the other information provided elsewhere in this Proxy Statement and the annexes hereto, you should carefully consider the risk factors relating to the Asset Sale Transaction and our future operations that are discussed beginning on page 16 below.

Information Concerning Solicitation and Voting

Our Board is soliciting proxies for the 2020 Special Meeting of Stockholders (the “Special Meeting”) to be held at [•] [a.m. / p.m.] Eastern Time on [•], 2020 at the Annualoffices of Troutman Sanders LLP, 600 Peachtree Street, NE, Suite 3000, Atlanta, Georgia 30308. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Special Meeting.

Voting materials, which include the Proxy Statement and Proxy Card, are being mailed to stockholders on or about [•], 2020. Our executive office is located at 1175 Peachtree Street NE, 10th Floor, Atlanta, Georgia 30361.

We will bear the expense of soliciting proxies. These expenses will include the expense of preparing and mailing proxy materials for the Special Meeting. We will reimburse banks, brokers and other custodians, nominees and fiduciaries for reasonable charges and expenses incurred in forwarding soliciting materials to their clients. We may conduct further solicitation personally or telephonically through our directors, officers, and employees, none of whom will receive additional compensation for assisting with the solicitation.

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

The following questions and answers are intended to briefly address commonly asked questions as they pertain to the Special Meeting, includingthe Asset Purchase Agreement and the Asset Sale Transaction. These questions and answers may not address all questions that may be important to you as a stockholder. Please refer to the “Summary” beginning on page 1 and the more detailed information contained elsewhere in this Proxy Statement and the annexes to this Proxy Statement, each of which you should read carefully.

WHAT IS A PROXY?

A proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document, that document is also called a “proxy” or a “proxy card.” If you are a street name holder, you must obtain a proxy from your broker, bank or other nominee in order to vote your shares in person at the Special Meeting.

WHAT IS A PROXY STATEMENT?

A proxy statement is a document that regulations of the United States Securities and Exchange Commission (the “SEC”) require that we give to you when we ask you to sign a proxy card to vote your stock at the Special Meeting.

WHO IS SOLICITING YOUR VOTE?

The Board is soliciting your vote for the Special Meeting being held at [•] [a.m. / p.m.] Eastern Time on [•], 2020, at the offices of Troutman Sanders LLP, 600 Peachtree Street, NE, Suite 3000, Atlanta, Georgia 30308.

WHAT WILL YOU BE VOTING ON?

(1) Approval of the Asset Purchase Agreement, the Asset Sale Transaction and the other transactions contemplated by the Asset Purchase Agreement; (2) approval of a proposal to adjourn or postpone the AnnualSpecial Meeting, if necessary or appropriate, for the purposes of soliciting additional votes for the approval of the Asset Sale Proposal; and (3) any other matters which may properly come before the meeting.

WHAT IS THE ASSET SALE PROPOSAL (PROPOSAL ONE)?

The Asset Sale Proposal is a proposal to permitsell the ECM Business to Buyer pursuant to the terms, and subject to certain conditions, of the Asset Purchase Agreement. Following the closing of the Asset Sale Transaction, we will continue to operate and manage our eValuator Coding Analysis Platform, CDI and Abstracting solutions, Financial Management solutions, Audit Services, and custom integration and training services.

WILL OUR COMMON STOCK STILL BE PUBLICLY TRADED IF THE ASSET SALE TRANSACTION IS COMPLETED?

Our common stock is currently traded on The NASDAQ Capital Market under the ticker symbol “STRM.” Following the completion of the Asset Sale Transaction, we expect that the common stock will continue to be traded on The NASDAQ Capital Market under the same ticker symbol. It is not possible to predict the trading price of our common stock following the closing of the Asset Sale Transaction. Accordingly, you may find it more difficult to dispose of your shares of common stock, and you may not be able to sell some or all of your shares of common stock when you desire. See “Risk Factors” on page 16 for a further discussion of some of these risks.

DID THE BOARD APPROVE AND RECOMMEND THE ASSET PURCHASE AGREEMENT?

Yes. The Board: (a) determined that it is fair to and in the best interests of the Company and its stockholders, and declared it advisable, to enter into the Asset Purchase Agreement and the Ancillary Agreements and to consummate the transactions contemplated thereby, including the Asset Sale Transaction, (b) approved the execution, delivery and performance of the Asset Purchase Agreement and the Ancillary Agreements and the closing of the transactions contemplated by the Asset Purchase Agreement and the Ancillary Agreements in accordance with Delaware law, and (c) resolved, subject to the terms and conditions set forth in the Asset Purchase Agreement, to recommend approval of the Asset Purchase Agreement by the stockholders of the Company.

WHAT HAPPENS IF THE ASSET SALE PROPOSAL (PROPOSAL ONE) IS NOT APPROVED?

If stockholders do not approve the Asset Sale Proposal, the Asset Sale Transaction will not occur. Instead, the Company will retain the assets and liabilities proposed to be sold in the Asset Sale Transaction and will not receive the $16 million cash consideration from Buyer, subject to certain adjustments as set forth in the Asset Purchase Agreement.

IF THE ASSET SALE PROPOSAL (PROPOSAL ONE) IS APPROVED, WHEN WILL THE ASSET SALE TRANSACTION CLOSE?

We currently anticipate that the Asset Sale Transaction will close promptly after the Special Meeting if the Asset Sale Proposal is approved, subject to the satisfaction or waiver of the closing conditions discussed elsewhere in this Proxy Statement.

WHAT IS THE ADJOURNMENT PROPOSAL (PROPOSAL TWO)?

The Adjournment Proposal is a proposal to adjourn or postpone the Special Meeting, if necessary or appropriate, to allow us to solicit additional proxiesvotes for the approval of the Asset Sale Proposal.

WHAT IS THE RECORD DATE AND WHAT DOES IT MEAN?

The Record Date to determine the stockholders entitled to notice of and to vote at the Special Meeting is the close of business on [•]. The Record Date was established by the Board as required by Delaware law. On the Record Date, [•] shares of common stock were issued and outstanding.

HOW MANY VOTES DO STOCKHOLDERS HAVE?

Holders of common stock at the close of business on the Record Date may vote at the Special Meeting. You will have one vote for every share of common stock you owned of record on the Record Date.

There is no cumulative voting.

HOW MANY VOTES MUST BE PRESENT TO HOLD THE MEETING?

A majority of the outstanding shares of common stock entitled to vote represented in favorperson or by proxy constitute a quorum. Abstentions and broker non-votes will count for purposes of any proposal,determining whether a quorum exists, but not for voting purposes.

HOW MAY I VOTE MY SHARES?

You can vote either in person at the persons namedSpecial Meeting or by proxy without attending the Special Meeting. We urge you to vote by proxy even if you plan to attend the Special Meeting so that we will know as soon as possible that enough votes will be present for us to hold the meeting.

(a) How may I vote my shares in person at the meeting?

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., on the Record Date, you are considered, with respect to those shares, the stockholder of record, and the proxy materials and proxy card are being sent directly to you by the Company. As the stockholder of record, you have the right to vote in person at the Special Meeting. If your shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in street name, and the proxy materials are being forwarded to you together with a voting instruction card. As the beneficial owner, you are also invited to attend the Special Meeting. Since you are a beneficial owner and not the stockholder of record, you may not vote these shares in person at the Special Meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares in its name, giving you the right to vote the shares at the Special Meeting.

(b) How can I vote my shares without attending the meeting?

Whether you hold shares directly as a registered stockholder of record or beneficially in street name, you may vote without attending the Special Meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker or nominee. In most cases, you will be able to do this by telephone, by using the Internet or by mail. Please refer to the summary instructions included with proxy materials and on your proxy card. For shares held in street name, the voting instruction card will be included in the materials forwarded by the broker or nominee. If you have telephone or Internet access, you may submit your proxy by following the instructions with your proxy materials and on your proxy card. You may submit your proxy by mail by signing your proxy card or, for shares held in street name, by following the voting instructions with your proxy materials and on your proxy card. You may submit your proxy by mail by signing your proxy card or, for shares held in street name, by following the voting instruction card included in the materials forwarded by your stockbroker or nominee and mailing it in the enclosed, postage paid envelope. If you provide specific voting instructions, your shares will be voted as you have instructed.

WHAT ARE THE BOARD’S RECOMMENDATIONS ON HOW I SHOULD VOTE MY SHARES?

The Board unanimously recommends that you vote your shares as follows:

Proposal One - FOR the Asset Sale Proposal; and

Proposal Two - FOR the Adjournment Proposal.

WHAT IF I DO NOT SPECIFY HOW I WANT MY SHARES VOTED?

If you are a record holder who returns a completed proxy card that does not specify how you want to vote your shares on one or more proposals, the designated proxies will vote onyour shares for each proposal as to which you provide no voting instructions, and such mattershares will be voted in their own discretion.the following manner:

RevocabilityProposal One - FOR the Asset Sale Proposal; and

Proposal Two - FOR the Adjournment Proposal.

If you are a “street name” holder and do not provide voting instructions on one or more proposals, your bank, broker or other nominee may be able to vote those shares.

HOW MANY VOTES ARE NEEDED TO APPROVE EACH PROPOSAL?

For Proposal One, the Asset Sale Proposal requires the affirmative vote of holders of at least a majority of our issued and outstanding shares of common stock that are entitled to vote at the Special Meeting. Stockholders may vote “for”, “against” or “abstain” for the Asset Sale Proposal. If you “abstain” from voting on the Asset Sale Proposal, your abstention will have the same effect as a vote “against” the Asset Sale Proposal.

For Proposal Two, the affirmative vote of the majority of the votes cast by stockholders present in person or represented by proxy at the Special Meeting is required to approve the Adjournment Proposal.

WHAT IS THE QUORUM REQUIREMENT?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the common stock issued, outstanding and entitled to vote are present at the Special Meeting in person or represented by proxy. On the Record Date, there were [•] shares of common stock issued and [•] outstanding and entitled to vote. Thus, the holders of [•] shares of common stock must be present in person or represented by proxy at the Special Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Special Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares of common stock present at the Special Meeting in person or represented by proxy may adjourn the Special Meeting to another date.

CAN YOU CHANGE YOUR VOTE?

Yes, a stockholder of record who has given a proxy may revoke it at any time prior to its exercise at the AnnualSpecial Meeting by (i) giving written notice of revocation to our Corporate Secretary, (ii) properly submitting a duly executed proxy bearing a later date, or (iii) appearing in person at the AnnualSpecial Meeting and voting in person.

If you are the beneficial owner of shares held through a broker, trustee, or other nominee, you must follow the specific instructions provided to you by your broker, trustee, or other nominee to change or revoke any instructions you already have provided to your broker, trustee, or other nominee.

Attendance at the AnnualSpecial Meeting, in and of itself, will not constitute a revocation of a proxy.

CostsWHAT IF YOU VOTE “ABSTAIN”?

A vote to “abstain” on any matter indicates that your shares will not be voted for such matter and will have the effect of a vote against the proposal. Abstentions are considered as being present for quorum purposes.

CAN YOUR SHARES BE VOTED IF YOU DO NOT RETURN YOUR PROXY AND DO NOT ATTEND THE SPECIAL MEETING?

A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Broker non-votes count for quorum purposes but not for voting purposes.

If you do not attend and vote your shares which are registered in your name or if you do not otherwise fill out the proxy card and vote by proxy, your shares will not be voted.

WHAT HAPPENS IF THE MEETING IS POSTPONED OR ADJOURNED?

Your proxy will still be valid and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy until it is actually voted.

WHAT IS HOUSEHOLDING OF SPECIAL MEETING MATERIALS?

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statement and annual reports. This means that only one copy of our Proxy SolicitationStatement to Stockholders may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of either document to you if you contact the Secretary at the following address or telephone number: 1175 Peachtree Street NE, 10th Floor, Atlanta, Georgia 30361 Tel: (888) 997‑8732. If you want to receive separate copies of this Proxy Statement in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker or other nominee record holder, or you may contact the Company at the above address or telephone number.

DO STOCKHOLDERS HAVE DISSENTER’S RIGHTS?

Stockholders do not have dissenter’s rights of appraisal with respect to any of the proposals being voted on.

WHAT SHOULD I DO IF I RECEIVE MORE THAN ONE SET OF VOTING MATERIALS?

You may receive more than one set of voting materials, including multiple copies of the Notice of Special Meeting or this Proxy Statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you will receive a notice for shares held in your name and a notice or voting instruction card for shares held in street name. Please follow the directions provided in the notice and each additional notice or voting instruction card you receive to ensure that all your shares are voted.

WILL I RECEIVE ANY PROCEEDS FROM THE ASSET SALE TRANSACTION?

No. The Company, and not its stockholders, will receive the proceeds from the Asset Sale Transaction.

HOW WILL THE COMPANY USE THE PROCEEDS FROM THE ASSET SALE TRANSACTION?

The Company, and not its stockholders, will receive the proceeds from the Asset Sale Transaction. The Company plans to use the proceeds of the sale to pay off its term loan with Bridge Bank and to fund the continuing development and incremental investment in sales and marketing in support of its eValuator™ cloud-based pre- or post-bill coding analysis platform. Following the closing of the Asset Sale Transaction, we will continue to operate and manage our eValuator Coding Analysis Platform, CDI and Abstracting solutions, Financial Management solutions, Audit Services, and custom integration and training services. Our Board will evaluate alternatives for the use of the cash proceeds to be received at closing to commercialize the foregoing business segments and to continue to maximize stockholder value with a goal of returning value to our stockholders. The amounts and timing of our actual expenditures, however, will depend upon numerous factors, and we may find it necessary or advisable to use portions of the proceeds from the Asset Sale Transaction for different or presently non-contemplated purposes..

WHAT ARE THE U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE ASSET SALE TRANSACTION TO U.S. STOCKHOLDERS?

The Asset Sale Transaction is a corporate action. Our stockholders will not realize any gain or loss for U.S. federal income tax purposes as a result of the Asset Sale Transaction. See “Proposal One: Asset Sale Proposal - Material U.S. Federal Income Tax Consequences” beginning on page 37.

WHAT ARE THE SOLICITATION EXPENSES AND WHO PAYS THE COST OF THIS PROXY SOLICITATION?

Our Board is asking for your proxy and we will pay all of the costs of asking for stockholder proxies. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of common stock and collecting voting instructions. We may use our officers and employees to ask for proxies, as described below.

WHERE CAN I FIND VOTING RESULTS?

The Company expects to publish the voting results in a Current Report on Form 8‑K, which it expects to file with the SEC within four business days following the Special Meeting.

WHO CAN HELP ANSWER MY QUESTIONS?

The information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the information contained in this Proxy Statement. We urge you to carefully read this entire Proxy Statement, including the documents we refer to herein. If you have any questions, need additional material, or require assistance in voting your shares, please feel free to contact Computershare Trust Company, N.A.. Stockholders may call Computershare Trust Company, N.A. toll-free at 800-368-5948.

RISK FACTORS

Risks Related to the Asset Sale Transaction

The announcement and pendency of the Asset Sale Transaction, whether or not consummated, may adversely affect our business.

The announcement and pendency of the Asset Sale Transaction, whether or not consummated, may adversely affect the trading price of our common stock, our business or our relationships with customers, suppliers and employees. In addition, pending the completion of the Asset Sale Transaction, we may be unable to attract and retain key personnel and the focus and attention of our management and employee resources may be diverted from operational matters during the pendency of the Asset Sale Transaction.

We cannot be sure if or when the Asset Sale Transaction will be completed.

The closing of the Asset Sale Transaction is subject to the satisfaction or waiver of various conditions, including Stockholder Approval. We cannot guarantee that the closing conditions set forth in the Asset Purchase Agreement will be satisfied. If we are unable to satisfy the closing conditions in Buyer’s favor or if other mutual closing conditions are not satisfied, Buyer will not be obligated to complete the Asset Sale Transaction. In the event that the Asset Sale Transaction is not completed, the announcement of the termination of the Asset Purchase Agreement may adversely affect the trading price of our common stock, our business and operations or our relationships with customers, suppliers and employees.

In addition, if the Asset Sale Transaction is not completed, our Board, in discharging its fiduciary obligations to our stockholders, may evaluate other strategic alternatives that may be available, which alternatives may not be as favorable to the Company and our stockholders as the Asset Sale Transaction.

The Asset Purchase Agreement limits our ability to pursue alternatives to the Asset Sale Transaction.

The Asset Purchase Agreement contains provisions that make it more difficult for us to sell our assets or engage in another type of acquisition transaction with a party other than Buyer. These provisions include a non-solicitation provision. These provisions could discourage a third party that might have an interest in acquiring all of, or substantially all of, our assets or our common stock from considering or proposing such an acquisition, even if that party were prepared to pay consideration with a higher value than the consideration to be paid by Buyer.

Our stockholders may not receive any of the proceeds of the Asset Sale Transaction

The proceeds from the Asset Sale Transaction will be paid directly to the Company and not our stockholders. As discussed elsewhere in this Proxy Statement, our Board will evaluate different alternatives for the use of the proceeds from the Asset Sale Transaction. The Company intends to use substantially all of the proceeds to pay transaction and other expenses of approximately $2.4 million; to repay its term loan with Bridge Bank; and to fund the continuing development and incremental investment in sales and marketing in support of its eValuator™ cloud-based pre- or post-bill coding analysis platform. The Board does not currently expect to declare a special dividend of any such proceeds to our stockholders.

We will incur significant expenses in connection with the Asset Sale Transaction, regardless of whether the Asset Sale Transaction is completed.

We expect to incur significant expenses related to the Asset Sale Transaction. These expenses include, but are not limited to, financial advisory and opinion fees and expenses, legal fees, accounting fees and expenses, certain employee expenses, filing fees, printing expenses and other related fees and expenses. Many of these expenses will be payable by us regardless of whether the Asset Sale Transaction is completed.

Risks Related to Our Future Operations

Our operations will be curtailed and we will have reduced sources of revenue following the Asset Sale Transaction, which may negatively impact the value and liquidity of our common stock.

Upon the closing of the Asset Sale Transaction, our operations will be curtailed as our sources of revenue will be limited to our non-ECM Business related operations. Although our Board intends to use the proceeds from the Asset Sale Transaction to pay off its term loan with Bridge Bank and to fund the continuing development and incremental investment in sales and marketing in support of its eValuator™ cloud-based pre- or post-bill coding analysis platform, there can be no assurance that we will be successful at carrying out such alternatives or that they will be successful at generating revenue. A failure by us to secure additional sources of revenue following the closing of the Asset Sale Transaction could negatively impact the value and liquidity of our common stock.

We have discretion in the use of the net proceeds from the Asset Sale and may not use them effectively.

If the Asset Sale Transaction is consummated, the purchase price for the ECM Business will be paid directly to the Company. Our management will have discretion in the application of the net proceeds from the Asset Sale Transaction and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business and cause the price of our common stock to decline. Pending their use, we may invest the net proceeds in a manner that does not produce income or that loses value. Although our Board will evaluate various alternatives regarding the use of the proceeds from the Asset Sale Transaction, it has made no decision with respect to the specific use of proceeds other than as described above and has not committed to making any such decision by a particular date. This uncertainty may negatively impact the value and liquidity of our common stock.

We will continue to incur the expense of complying with public company reporting requirements following the closing of the Asset Sale Transaction.

After the Asset Sale Transaction, we will continue to be required to comply with the applicable reporting requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), even though compliance with such reporting requirements is economically burdensome.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS